iCAN MOBILE BANKING

BILLS PAYMENTS

DIRECT & HASSLE FREE payments to

more than 100 Bayad Center

billers nationwide

DIRECT & HASSLE FREE payments to more than 100 Bayad Center billers nationwide

FUND TRANSFER

Cantilan bank is a proud member of PESONet. Bank customers that use the app can send money to another person through PESOnet.

FUND TRANSFER

Cantilan Bank customers can send money to another person through PESOnet.

Pay via QR Code

Cantilan Bank customers can pay via QR code at anytime to authorized iCANPay HERE merchants.

Contactless, quick, and secure transactions are made possibly by the QR Code feature.

Cantilan bank customers that are users of the app can do cash-in/cash-out transactions via QR code.

The QR code feature makes cash-in/cash-out transactions quicker and more secure and negates the chances of compromising the ATM Pin or card skimming.

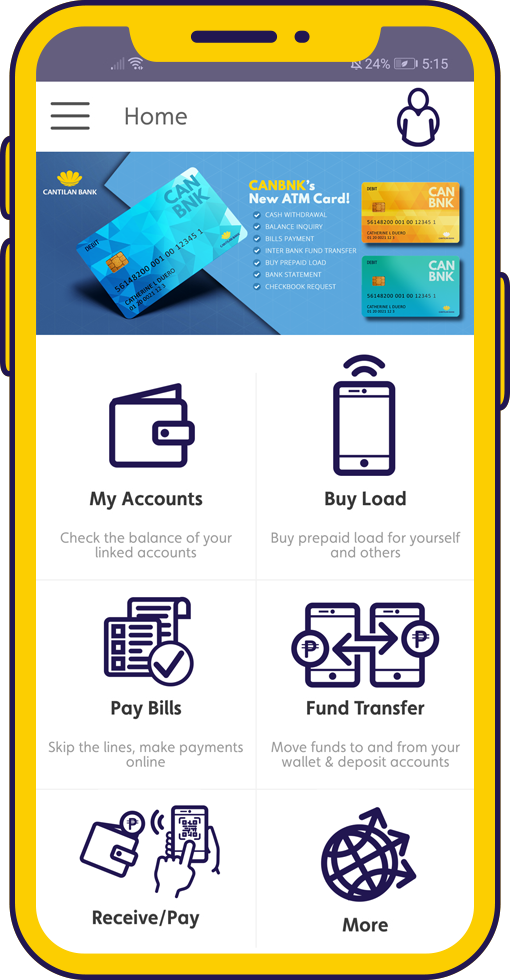

Easy Banking at your fingertips

The iCAN mobile banking app aims to Initiate financial literacy and empower its customers to take control of their financial future; Cultivate a Can-Do attitude giving customers the ability to bring about change in their lives; gives Access to the bank’s services in the convenience of their mobile phones;

and Nurtures bank customers to be self-reliant.

The iCAN mobile banking app aims to Initiate financial literacy and empower its customers to take control of their financial future; Cultivate a Can-Do attitude giving customers the ability to bring about change in their lives; gives Access to the bank’s services in the convenience of their mobile phones; and Nurtures bank customers to be self-reliant.

In-App Key Features

- Accounts-generating statement

- Cash-in/cash-out via QR code

- Personal financial management

- Recurring payments

- Loans application

- Nearest branch locator

- Product and service offers

- Quick messaging

- Real-time notification alerts

Secured 24/7 Banking

Protect bank details and account information

Create a new account anytime or access an existing one through a facial recognition scan. Our One-Time Pin (OTP) authentication also ensures the security of all your transactions.

Frequently Ask Questions

Who is Cantilan Bank?

What is Cantilan Bank's iCAN Mobile Banking?

What can I do with Cantilan Bank's iCAN Mobile Banking?

We are continuously developing new product features for you but as of the current version you can do the following:

- Inquire real-time balances for Current/Savings accounts

- Transfer funds to all pesonet member banks

- Pay bills for all Bayad Center billers

- Buy prepaid load (Globe, Smart, and Sun – yours or others)

Local transfer to other banks are limited to Philippine peso only

Is Cantilan Bank's iCAN Mobile Banking available 24/7?

Who can sign up to Cantilan Bank's iCAN Mobile Banking?

How do I sign up to Cantilan Bank's iCAN Mobile Banking?

How long does it take to sign up?

How fast is the response time for iCAN Mobile Banking?

Who can I transfer funds to?

Do I need to enroll billers that I want to pay?

Can I pay someone else's bill?

What airtime denominations may I load?

Various e-load denominations are available for use in iCAN Mobile Banking. You may refer to the list of the denominations per telephone caompnay below:

- Globe – Autoloadmax

- Smart/Talk n Text -Eload

- Sun Cellular – XpressLoad

Can I buy load for others?

How to delete my iCAN Mobile Banking account?

If On-Site:

- Visit the nearest branch with a valid ID.

- Submit a written request to delete your Mobile App Account.

- Branch Officers will validate and approve the deletion.

- Deletion request is forwarded to Mobile Banking Department (MBD) for processing.

If Off-Site:

- Contact customer service or use in-app notifications.

- Customer Service (CS) initiates identity verification via security questions.

- Send a valid ID and deletion request via email.

- MBD validates and approves the deletion.

Data to be deleted:

- Log-in credentials

- Device information (after 90 days)

Deletion Timeline:

- Mobile App Account will be deleted within 1 to 2 working days upon request approval. However, data is retained for 5 years per R.A. 9160 before complete removal from systems.